Macro Economics

Does Economics Growth Bring Increased Living Standards?

Increasing the rates of economic growth has long been the holy grail of conventional economics and politics. To a large extent, most developed economies have been highly successful in increasing economic output. But, has such an impressive increase in national output actually improved people's standard of living?To decide whether economic growth has increased happiness is highly subjective, and it is difficult for economists to make concrete arguments. However, it is worth noting the various side effects of growth and consider there impact on general living standards.

Benefits of Economic Growth

1. Increased consumption.

Consumers can benefit from consuming more goods and services. An assumption of economics is that consumption is related to utility, so in theory, with higher consumption levels, there is greater prosperity.2. Improved Public Services.

With increased Tax Revenues the government can spend more on important public services such as health and education. Improved health care can improve quality of life through treating diseases and increasing life expectancy. Increased educational standards can give the population a greater diversity of skills and literacy. This enables greater opportunity and freedom. Education is seen as an important determinant of welfare and happiness.3. Reduced Unemployment and Poverty.

Economic Growth helps to reduce unemployment by creating jobs. This is significant because unemployment is a major source of social problems such as crime and alienation. However, despite rapid increases in economic growth since the Second World War, areas of high unemployment in the EU remain. For example, in France and Spain there are currently high levels of structural unemployment. This kind of unemployment may not be reduced by economic growth.Why Economic Growth may not bring increased Happiness.

1. Diminishing Returns.

If a section of the population is living in absolute poverty, economic growth enables people to have higher incomes and therefore they will be able to afford the basic necessities of life such as; food, and shelter. When economic growth can overcome this type of poverty there is a clear link with improved living standards. However, when incomes increase from say $35,000 a year to $36,000 the improvement in living standards is harder to justify. Diminishing returns is a basic economic concept, which suggests the tenth unit of a good will give much less satisfaction than the first. If we already have 2 cars, does our living standards really improve if we now have the capacity to own 3 cars? Often as economic growth increases incomes, people increasingly save their money (higher marginal propensity to save) this is basically because they struggle to find anything meaningful to spend their money on.2.Externalities of Growth.

Economic Growth with involves increased output causes external side effects, such, as increased pollution. Global warming from pollution is becoming a real problem for society. The economic and social costs could potentially be greater than all the perceived benefits of recent economic growth. However, it is worth noting that economic growth doesn’t necessarily have to cause pollution. The benefits of growth could be used to develop better technologies that create less pollution. It is just at the moment this has been a low priority.2. Economic Growth can cause Increased Inequality.

It is perhaps a paradox that higher economic growth can cause an increase in relative poverty. This is because those who benefit from growth are often the highly educated and those who own wealth. In 1980s and 1990s higher growth in the UK and US has resulted in increased inequality. (1) However, it depends on how growth is managed; economic growtht can be used to reduce inequality. This occurred in 50s and 60s.3. Increase in Crime and Social problems.

It is another paradox that as incomes increase and people are better off the level of crime has increased as well. (2) This suggests that crime is not motivated by poverty but perhaps envy. One reason why crime rates increase is that quite simply there are more things to steal. Back in the 1930s auto theft, mobile phone theft e.t.c were rare or non-existent. Economic Growth has created more goods to steal. However the link isn’t absolute for example in recent years crime rates in US have reduced from their peak. But there has been a general association between growth and crimes.5. Higher Economic Growth has led to more hours worked.

In the beginning of the industrial revolution, higher growth led to people working lower hours.(3) However, in the past couple of decades higher incomes have actually led to people working longer hours. It seems people are unable to enjoy their higher incomes. Feeling the necessity or preferring to work longer hours. This suggest people are valuing earning money more than leisure. However, this trend may also be due to companies wanting people to work longer hours.6. Diseases of Affluence.

Economic Growth has enabled improved health care treatments, but at the same time there has been an unexpected rise in the number of diseases and illnesses related to increased prosperity.(4) One example is obesity. Modern lifestyles and modern diets have created an epidemic of obesity, with significant proportions of the population expressing a desire to lose weight. It could be argued that problems such as obesity and stress related illnesses are not a direct consequence of growth. This is true, but, it is symbolic of the fact increased prosperity has created as many new problems as it has solvedReferences

- Gary Burtless, Senior Fellow, Economic Studies Program “Has Income inequality really increased in US?” The Brookings Institution, January 11, 2007

- The United States Crime Index Rates Per 100,000 Inhabitants went from 1,887.2 in 1960 to 5,897.8 in 1991. By 1991 the crime rate was 313% the 1960 crime rate.

- A new study by the Organization for Economic Cooperation and Development (OECD) confirms that on average, people in the U.S. are putting in 20 per cent more hours of work than they did in 1970. See: Spark

- Obesity related illnesses rise with economic development Disease of Affluence

Conclusion

There are clearly some benefits of economic growth. These benefits are most visible when for low income countries. Economic growth enables the possibility to deal with many serious problems of poverty, homelessness and lack of basic amenities. However this paper is more interested in whether economic growth in developed economies is actually increasing living standards. Does rising incomes equal rising satisfaction? The answer is not clear-cut. However there are clearly several issues, which suggest that economic growth, has contributed to serious social, environmental and economic problems, which have reduced living standards. This is not to say economic growth is doomed to bring unhappiness. In fact the challenge is to harness the potential of economic growth to make sure it really does increase sustainable living standards.Citation : Pettinger, Tejvan. "Problems of Chinese Economy", Oxford, www.economicshelp.org, 26/03/07

Poverty, Income Inequality and Economic Growth

There are two types of poverty:- Relative Poverty: This is when income is less than the average income by a certain amount. For example, in the UK relative poverty is defined as income 50% less than average incomes. Therefore a rise in economic growth will cause a change in what constitutes economic growth.

- Absolute Poverty: This is Income below a certain level necessary to maintain a minimum standars of living. (e.g. enough money to buy the basic necessities of food, shelter and heat.

- Therefore, economic growth should reduce absolute poverty, so long as the poorest can gain some increase in living standards from the nation’s growth.

Does Economic Growth Reduce Relative Poverty and Income Inequality?

Economic Growth will reduce Income inequality if:

- Wages of the lowest paid rise faster than the average wage

- Government benefits, such as; unemployment benefits, sickness benefits and pensions are increased in line with average wages.

- Economic Growth creates job opportunities which reduce the level of unemployment. Unemployment and lack of employment is one of the biggest causes of relative poverty.

- Minimum Wages increased in line with average earnings

Why Economic Growth May not Reduce Income Inequality and Poverty

- Economic Growth often creates the best opportunities for those who are highly skilled and educated. In recent years, in the UK, we have seen faster wage growth for highly paid jobs than unskilled jobs.

- Modern economies are creating an increased number of part time / flexible service sector jobs. In these sectors wages have been lagging behind average earnings.

- In the UK, government benefits have been indexed linked. This means increased in line with inflation. This means that benefit incomes have fallen behind average earnings.

The Great Depression

In the Great Depression the response of classical economists was to cut govt spending such as unemployment benefits to try and balance the budget. However the effect of this was to reduce AD further.- Keynes argued that in order to help the economy it was necessary for the govt to kick start the economy by injecting money into the economy. Keynes argued for public work schemes which would employ those who were unemployed they would then be able to spend money which would create other jobs in the economy.

- This would cause a budget deficit but it was necessary.

- Unfortunately Keynes was largely ignored until after the war, leading to high unemployment until the Second World War

- Ironically the countries who were most successful in overcoming the great depression were military dictatorships who spent significant amounts on military spending

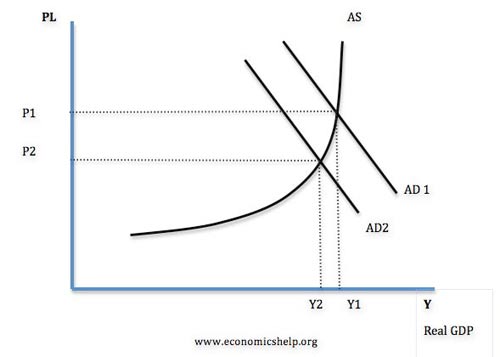

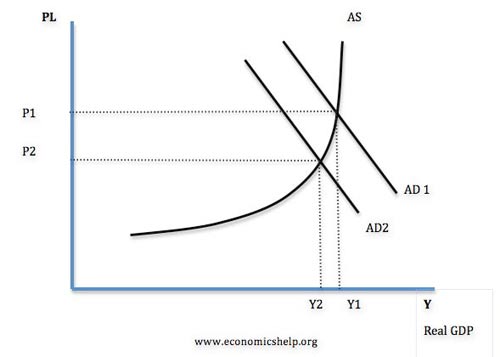

Diagram Showing Recession

Paradox of Thrift:

- In a recession Keynes noted that peoples psychology usually caused them to save more and spend less.

- However this was exactly what the economy didn’t want, because it would reduce AD further. Therefore Keynes argued that it was the job of the govt to encourage people to spend.

- See Fiscal Policy

- Causes of Recessions

Supply Side Policies

Definition of Supply Side Economics

Supply Side economics is the branch of economics that considers how to improve the productive capacity of the economy. It tends to be associated with Monetarist, free market economics. These economists tend to emphasise the benefits of making markets, such as labour markets more flexible. However, some supply side policies can involve government intervention to overcome market failureSupply Side Policies are government attempts to increase productivity and shift Aggregate Supply (AS) to the right.

Benefits of Supply Side Policies

1. Lower Inflation.Shifting AS to the right will cause a lower price level. By making the economy more efficient supply side policies will help reduce cost push inflation.

2. Lower Unemployment

Supply side policies can help reduce structural, frictional and real wage unemployment and therefore help reduce the natural rate of unemployment.

See: Supply side policies for reducing unemployment

3. Improved economic growth

Supply side policies will increase the sustainable rate of economic growth by increasing AS.

4. Improved trade and Balance of Payments.

By making firms more productive and competitive they will be able to export more. This is important in light of the increased competition from S.E. Asia.

see also: Economic Importance of Supply Side Policies

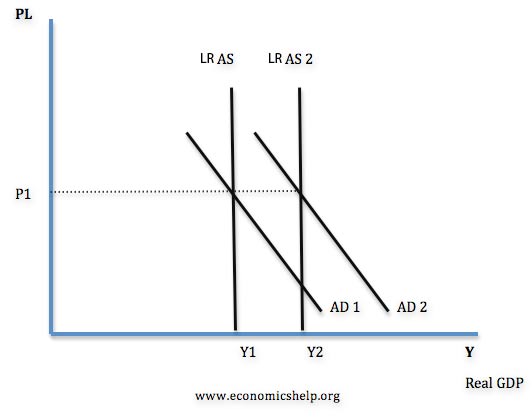

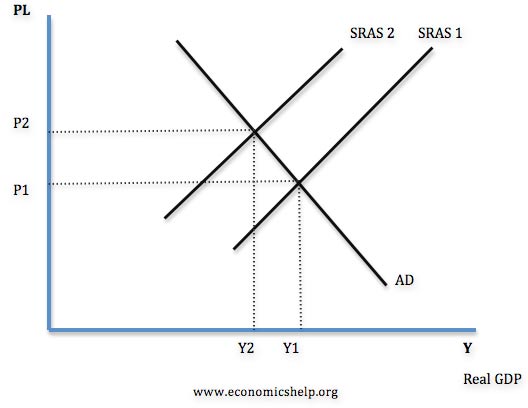

Diagram Showing effect of Supply Side Policies

Classical view of LRAS shifting to the right.

Keynesian view of LRAS shifting to the righ.

Supply Side Policies

Most supply side policies aim to enable the free market to work more efficiently by reducing govt interference.1. Privatisation.

This involves selling state owned assets to the private sector. It is argued that the private sector is more efficient in running business because they have a profit motive to reduce costs and develop better services.

See more on Privatisation

2. Deregulation

This involves reducing barriers to entry in order to make the market more competitive. For example BT used to be a Monopoly but now telecommunications is quite competitive. Competition tends to lead to lower prices and better quality of goods / service.

3. Reducing Income Taxes.

It is argued that lower taxes (income and corporation) increase the incentives for people to work harder, leading to more output.

However this is not necessarily true, lower taxes do not always increase work incentives (e.g. if income effect outweighs substitution effect)

4. Increased education and training

Better education can improve labour productivity and increase AS.

Often there is under-provision of education in a free market, leading to market failure. Therefore the govt may need to subsidise suitable education and training schemes.

However govt intervention will cost money, requiring higher taxes, It will take time to have effect and govt may subsidise the wrong types of training

5. Reducing the power of Trades Unions

This should

a) increase efficiency of firms e.g. less time lost to strikes

b) reduce unemployment ( if labour markets are competitive)

6. Reducing State Welfare Benefits

This may encourage unemployed to take jobs.

7. Providing better information about jobs

This may also help reduce frictional unemployment

8. Deregulate financial markets to allow more competition and lower borrowing costs for consumers and firms.

9. Lower Tariff barriers this will increase trade

10. Removing unnecessary red tape and bureaucracy which add to a firms costs

11. Improving Transport and infrastructure.

Due to market failure this is likely to need govt intervention to improve transport and reduce congestion. This will help reduce firms costs.

12 Deregulate Labour Markets

This is said to be an important objective for the EU to increase competitiveness. E.g. Make it easier to hire and fire workers.

Causes of Economic Growth

- Economic growth means an increase in real GDP. Economic growth means there is an increase in national output and national income.

- Economic growth is caused by an increase in aggregate demand and / or an increase in aggregate supply (productive capacity)

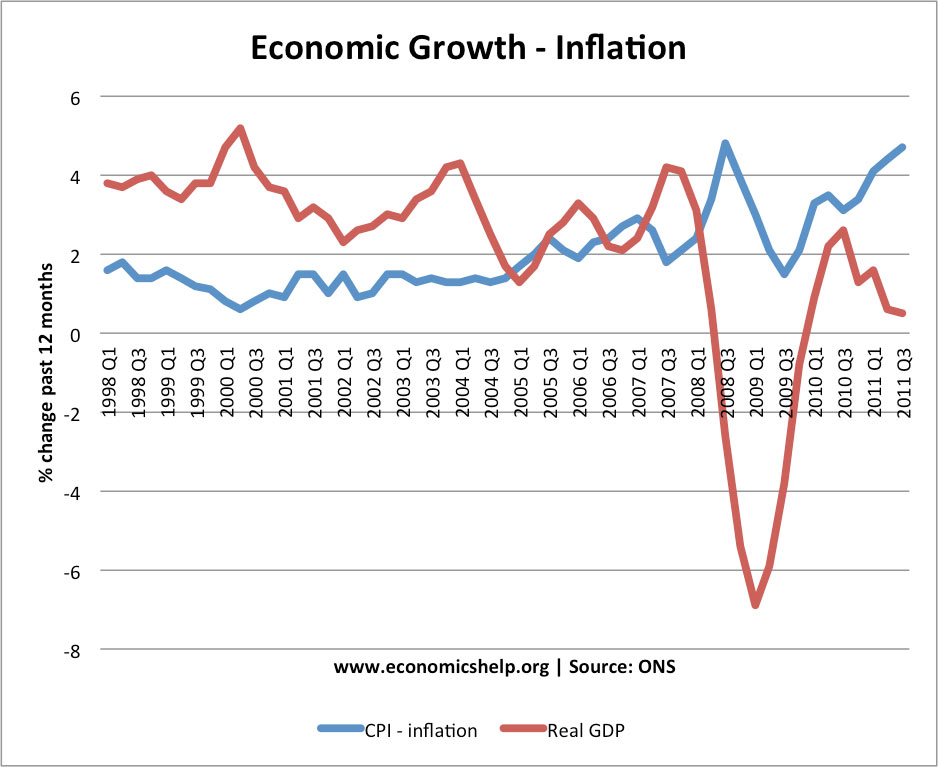

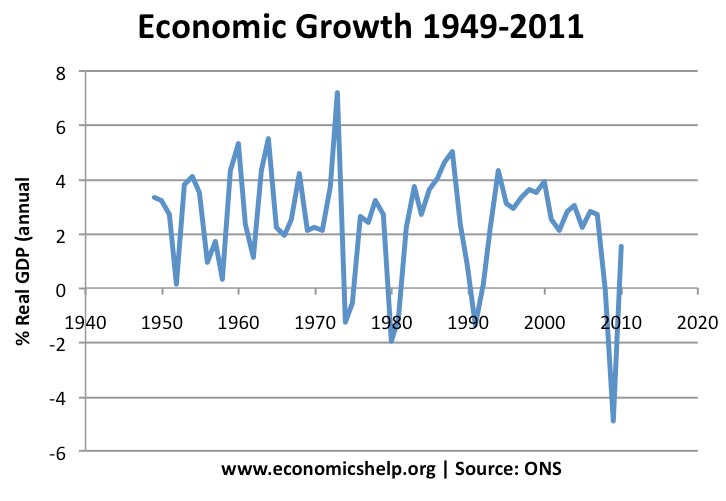

Recent Economic Growth in UK

Economic growth is measured by the % change in real GDP

Demand Side Causes

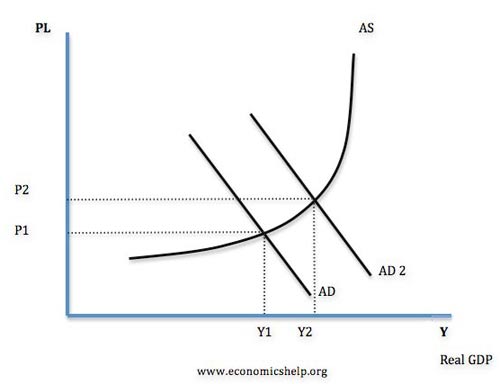

In the short term, economic growth is caused by an increase in AD. If there is spare capacity in the economy then an increase in AD will cause a higher level of real GDP.AD= C + I + G + X- M

- C= Consumer spending

- I = Investment

- G = Government spending

- X = Exports

- M = Imports

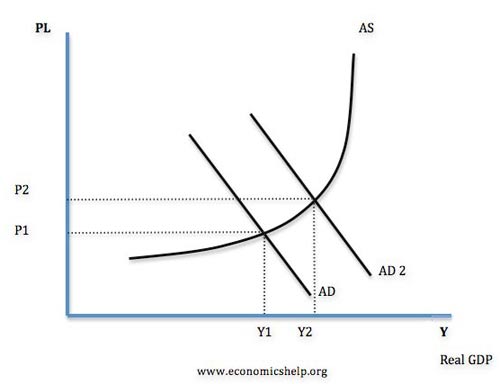

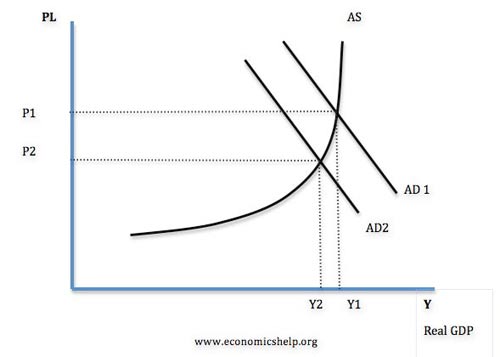

Graph Showing Increase in AD

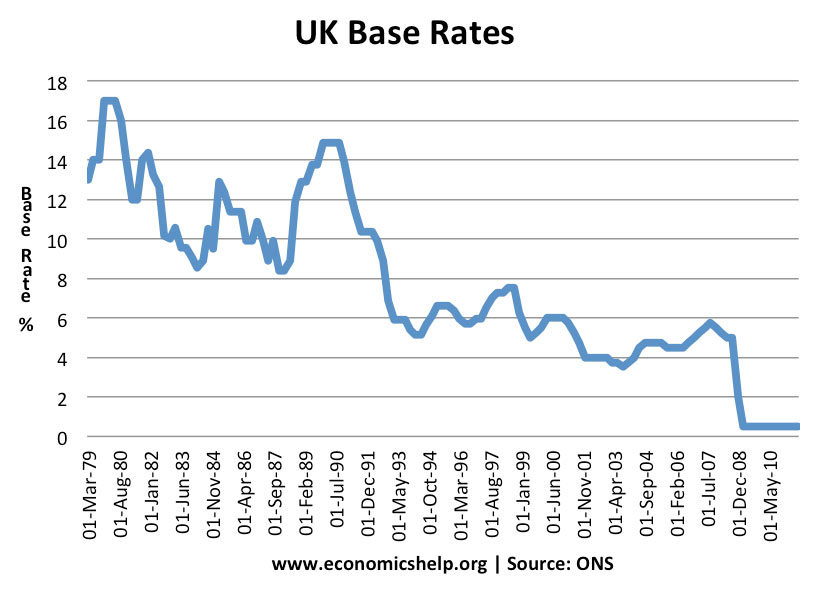

- Lower interest rates – Lower interest rates reduce the cost of borrowing and so encourages spending and investment.

Base rates cut to 0.5% to try and stimulate economic growth.

- Increased wages. Higher real wages increase disposable income and encourages consumer spending.

- Increased Government spending.

- Fall in value of sterling which makes exports cheaper and increases quantity of exports.

2. Long Term Economic Growth.

This requires an increase in the Long Run Aggregate Supply as well as AD.Diagram showing Long Term Economic Growth

LRAS or potential growth can increase for the following reasons:

- Increased capital. E.g. investment in new factories or investment in infrastructure, such as roads and telephones.

- Increase in working population, e.g. through immigration, higher birth rate.

- Increase in Labour productivity, through better education and training or improved technology.

- Discovering new raw materials.

- Technological improvements to improve the productivity of capital and labour e.g. Microcomputers and the internet have both contributed to increased economic growth.

Graph Showing Annual Growth in UK

In 2009, the sharp fall in Real GDP (negative economic growth) was caused by:

- Higher oil prices reducing living standards

- Global credit crunch leading to a fall in bank lending and investment

- Fall in house prices causing lower wealth and spending

Different Views on Economic Growth

Classical Economists argue that an increase in AD will only increase Real GDP in the short term. They argue that the LRAS is inelastic therefore higher AD only causes inflation. Classical economists stress the role of supply side policies in increasing economic growth.This is disputed by Keynesians. They believe the LRAS can be elastic, e.g. in a recession.

Causes of Recessions

A recession implies a fall in Real GDP. An official definition of a recession is a period of negative economic growth for two consequative quarters.Recession of 2009

This graph shows negative economic growth between Q3 2008 and early 2010.

Main Causes of Recession

1. Demand Side Shock

Factors that can cause a fall in aggregate demand:

- Higher interest rates which reduce borrowing and investment

- Falling real wages

- Falling consumer confidence

- Credit crunch which causes a decline in bank lending and therefore lower investment.

- A period of deflation. Falling prices often encourage people to delay spending. Also deflation increases the real value of debt.

- Appreciation in exchange rate which makes exports expensive and reduces demand for exports.

2. Supply Side Shock

Higher oil prices would increase cost of production and causes short run aggregate supply to shift to the left.

Video on Cause of 2008/09 Recession

Essay on Causes of Recession

A recession occurs when there is a fall in economic growth for two consecutive quarters. However if growth is very low there will be increased spare capacity and increased unemployment; people will feel there is a recession. This is sometimes known as a growth recession. see also: Definition of RecessionsIf there is a fall in AD then according to Keynesian analysis there will be a fall in Real GDP. The effect on Real GDP depends upon the slope of the AS curve if the economy is close to full capacity lower AD would only cause a small fall in Real GDP.

AD is composed of C+I+G+X-M, therefore a fall in any of these components could cause a recession. For example, if the MPC increased interest rates sharply this would cause the cost of borrowing to increase and make saving more attractive. This would have the effect of reducing consumer spending. AD could also fall due to deflationary fiscal policy, for example higher taxes and lower government spending would also cause a fall in AD.

If there was a fall in AD the multiplier effect may magnify the initial fall in A. For example if there was a fall in output, workers would be made unemployed. These workers would then spend less causing a secondary fall in AD. This would make the fall in Real GDP greater.

A key feature in determining the rate of economic growth is the level of consumer and business confidence. If confidence was high then higher interest rates may not reduce demand. However if confidence is low and people fear they may be made unemployed, then they will start spending less, causing AD to fall (or increase at a slower rate). Therefore this shows that expectations are very important and it is possible for “people to talk themselves into a recession”

An important feature of the UK economy is international trade, therefore the UK would be affected by a global recession. For example a recession in the EU would cause a fall in demand for UK exports reducing our AD (EU accounts for 60% of our trade therefore is important). Also a recession in other countries would effect economic confidence if people see the US in a recession they are worried and will spend less. However a global recession may not cause a recession in the UK if domestic demand remains high.

Classical Economists believe that any fall in Real GDP will be temporary and will end when labour markets adjust to the new price level. Classical economists argue that if there is a fall in AD then in the short term there will be a fall in Real GDP. However with a lower price level wages will fall therefore the SRAS will shift to the right and the economy will return to the original level at Yf and the recession will be over.

However in the great depression of 1930s Keynes was very critical of this classical view he said that the long period of negative growth showed that markets do not automatically clear he argued that this was for various reasons.

- Wages are sticky downwards, Firms should cut wages to reflect lower prices but in reality workers are very resistant to cuts in nominal wages

- If wages were cut in response to unemployment workers would have less spending power therefore AD would continue to fall.

- In a recession people have low confidence and therefore spend less. Keynes said this was the “Paradox of Thrift”

Recessions in UK

Causes of 1981 Recession

- High strength of the pound which made exports more expensive and reduced AD. This recession particularly effected British manufacturing.

- High interest rates. The govt was

committed to reducing high inflation they inherited. They maintained a

tight monetary policy which reduced inflation but at a cost of falling

spending, investment and output.

- Tight Fiscal Policy. To control inflation the government were committed to reducing the levels of Government borrowing. This was influenced from Monetarist beliefs that controlling excess government borrowing was essential to the economy. Therefore the government increased taxes which reduced the disposable income of consumers and therefore reduced consumer spending.

Causes of 1991 Recession

- BOOM and BUST. In the 1980s economic growth was too fast and unsustainable therefore inflation increased to over 10%. To reduce this inflation the government increased interest rates which lowered spending.

- Joining the Exchange Rate Mechanism. The government became committed to maintaining a high value of the pound. This required high interest rates of up to which caused a big fall in Aggregate demand. Also, because the pound was overvalued, exports were expensive causing less demand for UK exports.

- High interest rates increased the cost of mortgage interest payments. Many were forced to sell. This caused a fall in house prices. Falling house prices caused a decline in consumer wealth and lower confidence. This also caused lower spending.

Causes Recession of 2008/09

- Credit crunch - shortage of finance (Credit Crunch explained)

- Falling house prices - related to shortage of mortgages and credit crunch

- Cost push inflation squeezing incomes and reducing disposable income

- Collapse in confidence of finance sector causing lower confidence amongst 'real economy'

Aggregate Demand

Aggregate Demand (AD) is the total demand for goods and services produced within the economy over a period of time.Aggregate Demand (AD) is composed of various components

AD = C+I+G+(X-M)

- C = Consumer expenditure on goods and services.

- I = Gross Capital Investment – i.e. investment spending on capital goods e.g. factories and machines

- G = Government Spending e.g. spending on NHS, education. Note transfer payments in the form of pensions and unemployment benefits are not included because they are not related to output produced.

- X = Exports of goods and Services. Goods leave the country but money from abroad flows into the economy, therefore this is an increase in AD (an injection in to the circular flow)

- M = Imports of goods and Services, although goods enter the country money is leaving the economy to go to other countries, therefore AD falls

AD slopes downwards because:

- i) At a lower price level people are able to consume more goods and services, because there Real income is higher

- ii) At a lower price level interest rates usually fall causing increased AD

Shifts in the Aggregate Demand curve

Graph to show Increase in AD

An increase in AD (shift to the right of the curve) could be caused by a variety of factors

1. Increased Consumption:

- i) An increase in consumers wealth (higher house prices or value of shares)

- ii) Lower Interest Rate which make borrowing cheaper therefore people spend more on credit cards. Also mortgage payments are cheaper which gives people more disposable income.

- iii) Higher wages

- iv) Lower Taxes

- v) Increased consumer confidence about the future

2. Increased Investment

- i) Lower interest rates, this makes borrowing for investment cheaper.

- ii) Increased confidence in the economic outlook

- iii) Improved technology

- iv) Increased economic growth, to meet increased demand firms need to increase capacity

- i) Government pursues expansionary fiscal policy

- ii) Governments invests in infrastructure

- i) UK more competitive, for example an increase in labour productivity would make the UK more competitive

- ii) Increased growth in other countries, therefore they will have higher demand

- iii) Lower value of Sterling, this makes exports cheaper

- i) UK more competitive, this makes goods from other countries appear less competitive.

- ii) Lower value of Sterling, this makes imports more expensive

- iii) Lower GDP, therefore consumers will have less money to spend.

Micro Economics

UK Competition Policy

Definition of Competition Policy: Government policies to prevent and reduce the abuse of monopoly power.

Abuse of monopoly power can lead to market failure and be against the public interest. Therefore Governments are concerned to intervene and protect the interests of the consumers

1998 Competition Act sought to bring the UK into line with EU competition policy

The OFT is responsible for investigating suspected abuses of monopoly power and engaging in prohibited practices. There are 2 main types of behaviour they investigate:

- Collusive Behaviour

- Abuse of Market Power

Collusive Behaviour

This occurs when firms enter into agreements to fix prices and or output. This enables firms to make higher proits at the expense of consumers.Collusive tendering. This occurs when firms enter into agreements to fix the bid at which they will tender for projects. Firms will take it in turns to get the contract and enable a much higher price for the contract.

Collusive behaviour is illegal and can be investigated by the OFT.

Abuse of Market Power

If a firm has more than 40% of market share it is considered to have market power. The OFT are more likely to investigate firms with a dominant market position. Though they can also investigate people with less market share. Abuse of Market Power may include:- Predatory Pricing - selling below cost with intention of forcing a rival firm out of business

- Charging Higher prices - a Monopoly is able to set high prices. The OFT may consider this abuse of monopoly power if it leads to excess profits.

- Vertical Restraints - Firms may use market power to pay lower prices to suppliers (e.g. Supermarkets have been criticised for paying low prices to farmers.

- Tie in Sales. E.g. A printer which makes people may its own brand very expensive ink.

Merger Policy

The OFT can recommend mergers be referred to the Competition Commission - to see whether the merger is in the public interest.Examples of Competition Policy

- Investigation into grocery market - largely cleared big supermarkets of unfair practises.

- Merger between HP foods and Heinz accepted by Competition Commission

Economic Costs

Definition of Economic costs

· Fixed Costs: These are fixed costs that do not vary with output. E.g. cost of building a factory

· Variable Costs: These are costs that do vary with output

E.g. electricity, raw materials

· Total Costs: Fixed + variable costs

· Marginal Cost: This is the cost of producing an extra unit

· Sunk Costs: These are costs that are not recoverable e.g. advertising

Average Costs

· Average Total Cost (ATC) = TC / Q· Average Variable Cost (AVC) = VC / Q

· Average Foxed Costs (AFC) = FC / Q

Definition of Economies of Scale

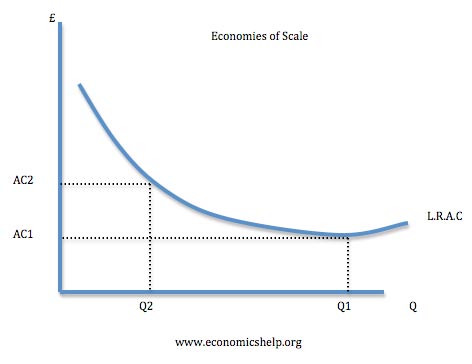

Economies of scale occur when its Long Run Average Costs fall with increasing output.Therefore increasing production leads to increasing returns to scale and there is greater efficiency.

Diagram of Economies of Scale

Increasing output from Q2 to Q1, we see a decrease in long run average costs

Economies of Scale occur for various reasons.

1. Specialization and division of labour:In large scale operations workers can do more specific tasks. With little training they can become very proficient in their task, this enables greater efficiency. A good example is an assembly line with many different jobs.

2. Technical.

Some production processes require high fixed costs e.g. building a large factory. If a car factory was then only used on a small scale it would be very inefficient to run. By using the factory to full capacity average costs will be lower.

3. Bulk buying:

If you buy a large quantity then the average costs will be lower. This is because of lower transport costs and less packaging. This is why supermarkets get lower prices from suppliers than local corner shops.

4. Spreading overheads.

If a firm merged it could rationalise its operational centres. E.g. it could have one head office rather than two.

5. Risk Bearing economies.

Some investments are very expensive and perhaps risky, therefore only a large firm will be able and willing to undertake the necessary investment. E.g. pharmaceutical industry needs to take risks in developing new drugs

6. Marketing Economies of scale.

There is little point a small firm advertising on a national TV campaign because the return will not cover the high sunk costs

7. The container principle.

To increase capacity 8 fold it is necessary to increase surface area only 4 fold.

8. Financial economies.

A bigger firm can get a better rate of interest than small firms

9. External economies of scale:

This occurs when firms benefit from the whole industry getting bigger. E.g. firms will benefit from better infrastructure, access to specialized labour and good supply networks. E.g. micro chip producers often set up in Silicon valley

Internal Economies of Scale.

Most of the above economies of scale are internal. It means the economies benefit the firm when it grows in sizeStudies in Economies of Scale

Studies in Economies of Scale suggest that to attain the lowest point on the Long run average costs the minimum number of cars to be produced in 1 year is 400,000Economic Efficiency

The fundamental economic problem is a scarcity of resources.Definition of Efficiency

Efficiency is concerned with the optimal production and distribution or these scarce resources.

There are different types of efficiency

1. Productive efficiency.This occurs when the maximum number of goods and services are produced with a given amount of inputs. This will occur on the production possibility frontier. On the curve it is impossible to produce more goods without producing less services.Productive efficiency will also occur at the lowest point on the firms average costs curve

See: Productive Efficiency

2. Allocative efficiency

This occurs when goods and services are distributed according to consumer preferences. An economy could be productively efficient but produce goods people don’t need this would be allocative inefficient.

A2: Allocative efficiency occurs when the price of the good = the MC of production

See: Allocative Efficiency

3. X inefficiency:

This occurs when firms do not have incentives to cut costs, for example a monopoly which makes supernormal profits may have little incentive to get rid of surplus labour. Therefore a firms average cost may be higher than necessary.

See: X Inefficiency

4. Efficiency of scale

This occurs when the firms produces on the lowest point of its Long run average cost and therefore benefits fully from economies of scale

5. Dynamic efficiency This refers to efficiency over time for example a Ford factory in 1920 would be very efficient for the time period, but by comparison would now be inefficient.. Dynamic efficiency involves the introduction of new technology and working practises to reduce costs over time.

- Dynamic Efficiency

- Static Efficiency - efficiency at a particular point in time.

This occurs when externalities are taken into consideration and occurs at an output where the social cost of production (SMC) = the social benefit (SMB)

See: Social Efficiency

7. Technical Efficiency

Optimum combination of factor inputs to produce a good: related to productive efficiency.

See: Technical Efficiency

8. Pareto Efficiency

A situation where resources are distributed in the most efficient way. It is defined as a situation where it is not possible to make one party better off without making another party worse off.

See: Pareto Efficiency

9. Distributive Efficiency

Concerned with allocating goods and services according to who needs them most. Therefore, requires an equitable distribution.

See: Distributive Efficiency

Source: Economic help, updated: May 5, 2012

No comments:

Post a Comment